After the United States, Europe, and Japan successfully challenged China’s export restrictions on rare earths earlier this year the Chinese government is formulating contingency plans to accommodate a possible end to the current tariffs and quotas in the next year. It is expected that new measures will further tighten control over the country’s rare earths upstream sector.

In order to conserve resources and protect the environment China has adopted a series of policies and measures to bring the rare earths minerals under state control in the past few years but the industry is beset by a slew of problems, such as illegal rare earth mining, trading and smuggling. Excessive exploration has also caused environmental damage.

In fact, in order to crack down on the illegal rare earth black market as well as to regulate the trading sector the Chinese authorities have allowed three Exchanges to open its REE spot trading business since this year. This includes the Baotou Rare Earth Products Exchange in Inner Mongolia Baotou, Tianjin Bohai Commodity Exchange in Tianjin, and Hunan South Rare Precious Metals Exchange in Guangdong Pinyuan respectively. It is worthwhile to note that China will add rare earths to the Shanghai Futures Exchange before long.

In January, the Chinese government yet officially launched a new round of rare earth industry consolidation plan for the rare earth mining and rare earth smelting and separation sector, while promote mergers led by 6 major producers in order to maintain consistent rare earth production and quality control. Meanwhile, the government will increase taxes on rare earth as one of its alternative measures to remove export duties and quotas in the second half of this year.

Currently, China’s six giants has monopolized on its domestic rare earth mining correctly and will further do so in order to control over the smelting and separation sector through by a new round of rare earth industry consolidation plan this year. As a result the Chinese small rare earth smelting and separation plants, of which most of them will be forced to merge by China’s six giants or have to be closed due to a lack of mining properly and supplying sources of rare-earths in the domestic market.

China’s further restrictive policy on domestic rare earth mining will result in some Chinese rare earth producers to increase imports of rare earth minerals from the rest of the world through cooperation with foreign rare earth suppliers. After losing a WTO rare earth lawsuit case the trend is that not only the Chinese government is to impose new taxes and thus pushing up the rare earth price, but also to encourage Chinese rare earth producers to increase imports of rare earth.

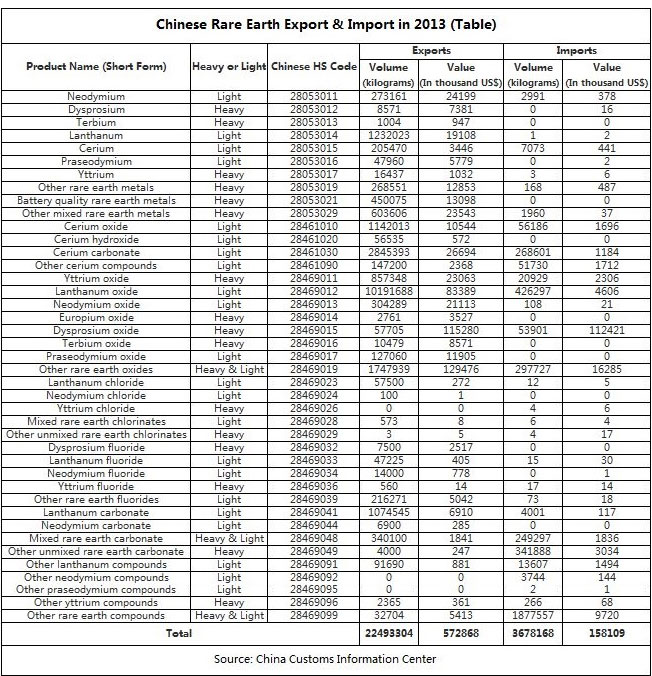

Influenced by China’s rare earth policy of domestic rare earth mining quotas, in fact, China’s rare earth imports were rising in the past year. Figures from the China Customs Statistics Information Center showed that China imported a total of 3678.17 tons of rare earth ores, metal and compounds in 2013, which increased by 56.68% from 2347.5 tons of a year before. The value of rare earth imports also surged by 130.18% year-on-year to USD $ 158.109 million (China’s value of rare earth imports was at USD$ 68.688 million in 2012). China’s rare earth exports and imports of rare earths, rare earth ores, metals and compounds in 2013 are shown in the table below:

Despite the fact that China is the world’s largest rare earth producer and exporter and accounts for about 90% of the global production, the country currently consumed approximately 70%-80% of its own rare earths. China’s limiting of rare-earths is making others rethink their industrial strategies even as some of the Chinese rare earth producers are also seeking supply sources of rare-earths in the worldwide. Therefore, I expect that China’s rare earth imports will remain on the rise this year.